We at Met Holding provides you all kinds of solution. With our expert team we will help you to get the fund fast and able to achieve your goal.

Standby Letter Of Credit

A Standby Letter of Credit (SBLC) is a guarantee issued by a bank on behalf of a client, ensuring payment to the beneficiary in the event that the client fails to fulfill their contractual obligations. It serves as a backup financial security, typically used in international trade and business agreements. At MET Holding, we help businesses secure Standby Letters of Credit (SBLC) from reputable financial institutions, offering a secure and flexible payment method without blocking cash funds. Our expert team ensures a seamless process, helping businesses gain the trust of their partners and secure their transactions with confidence.

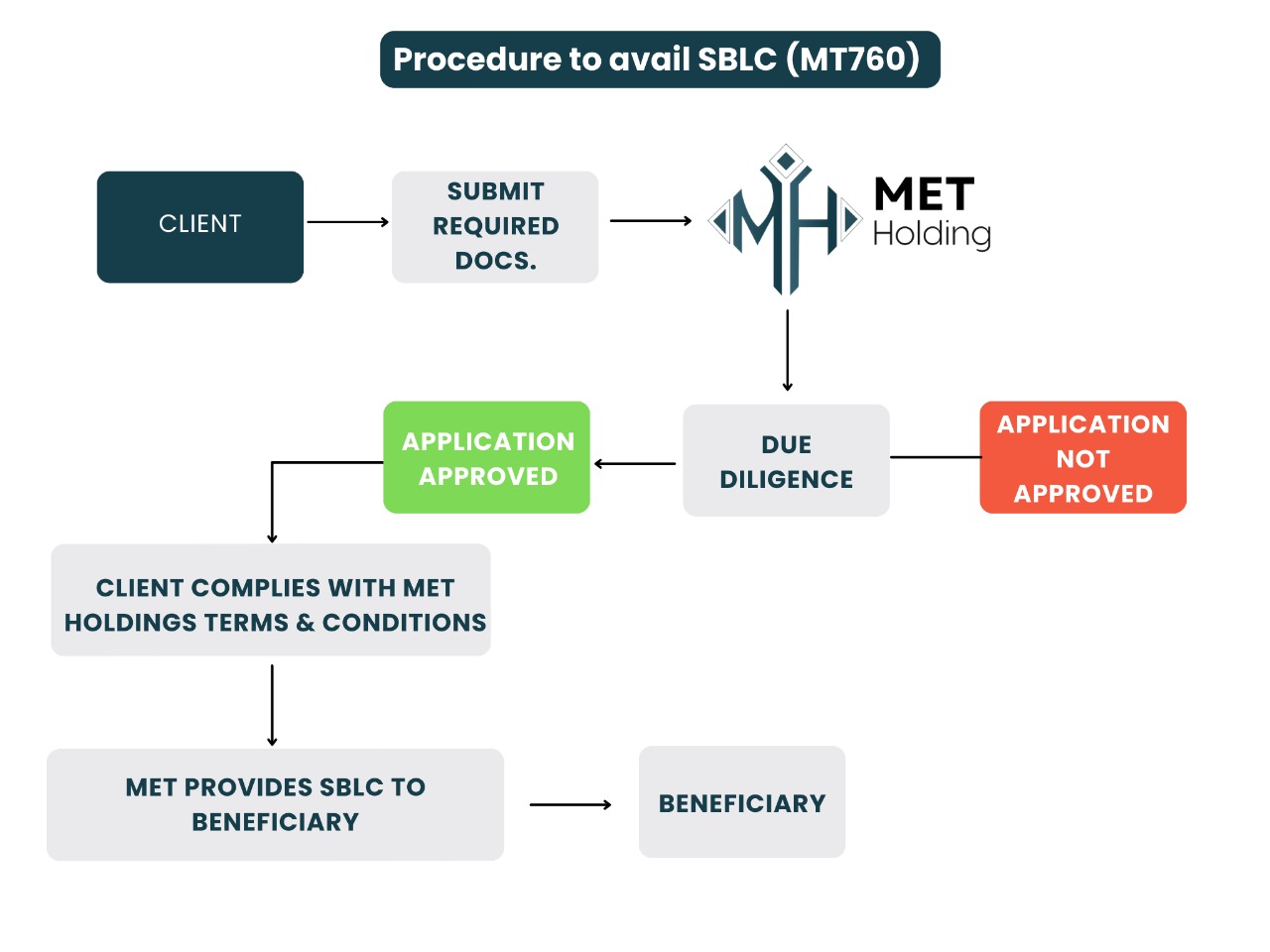

SBLC Process at MET Holding

At MET Holding, we provide expert consultancy and support to businesses involved in imports and exports by assisting with the issuance of Standby Letters of Credit (SBLC) to ensure secure trade transactions. Our process ensures both importers and exporters can confidently conclude their trade deals with financial security.

To avail of SBLC assistance through MET Holdings, follow the simple process below:

1. Initial Request Submission

The buyer submits their SBLC request along with the relevant Sales and Purchase Agreement or proforma offer outlining the terms of the trade deal.

2. Review and Approval

Our expert team at MET Holdings carefully reviews the trade deal between the buyer and seller to ensure all terms are in line with the requirements for an SBLC. After our review, we will inform the buyer about the approval of their request.

3. Service Agreement and Admin Charges

If the request is approved, we will proceed to sign a service agreement with the client. At this stage, the buyer is instructed to pay the admin charges to initiate the SBLC transaction and move forward with the process.

4. Structuring and Documentation

Upon receiving the admin charges, we will structure the SBLC and send a draft to the buyer for their review and approval. In parallel, we will guide the buyer in providing the necessary documents required for the issuance. Additionally, the buyer will be informed of the issuance fee, which is required to proceed.

5. Finalizing and Issuance of SBLC

Once the draft is approved and the issuance fee is paid, we will instruct our partner bank to issue the Standby Letter of Credit. The SBLC will be issued via authenticated SWIFT MT760 on behalf of the buyer and in favor of the seller, ensuring the trade is secured and compliant.

MET Holding provides comprehensive banking consultancy throughout this process, ensuring all documentation is in order, and guiding our clients to successful and secure trade deals.