We at Met Holding provides you all kinds of solution. With our expert team we will help you to get the fund fast and able to achieve your goal.

Banking Credit Line

A Credit Line is a financial arrangement between a business and a financial institution that allows the business to borrow funds up to a predetermined limit. It provides flexible access to capital, helping businesses manage cash flow, handle operational costs, or fund projects without the need to secure a traditional loan. At MET Holding, we assist businesses in obtaining Credit Lines from rated financial institutions, offering financial flexibility to support growth, expansion, and day-to-day operations. With our expert consultancy, we guide clients through the process of securing a credit line to ensure smooth business operations and financial stability.

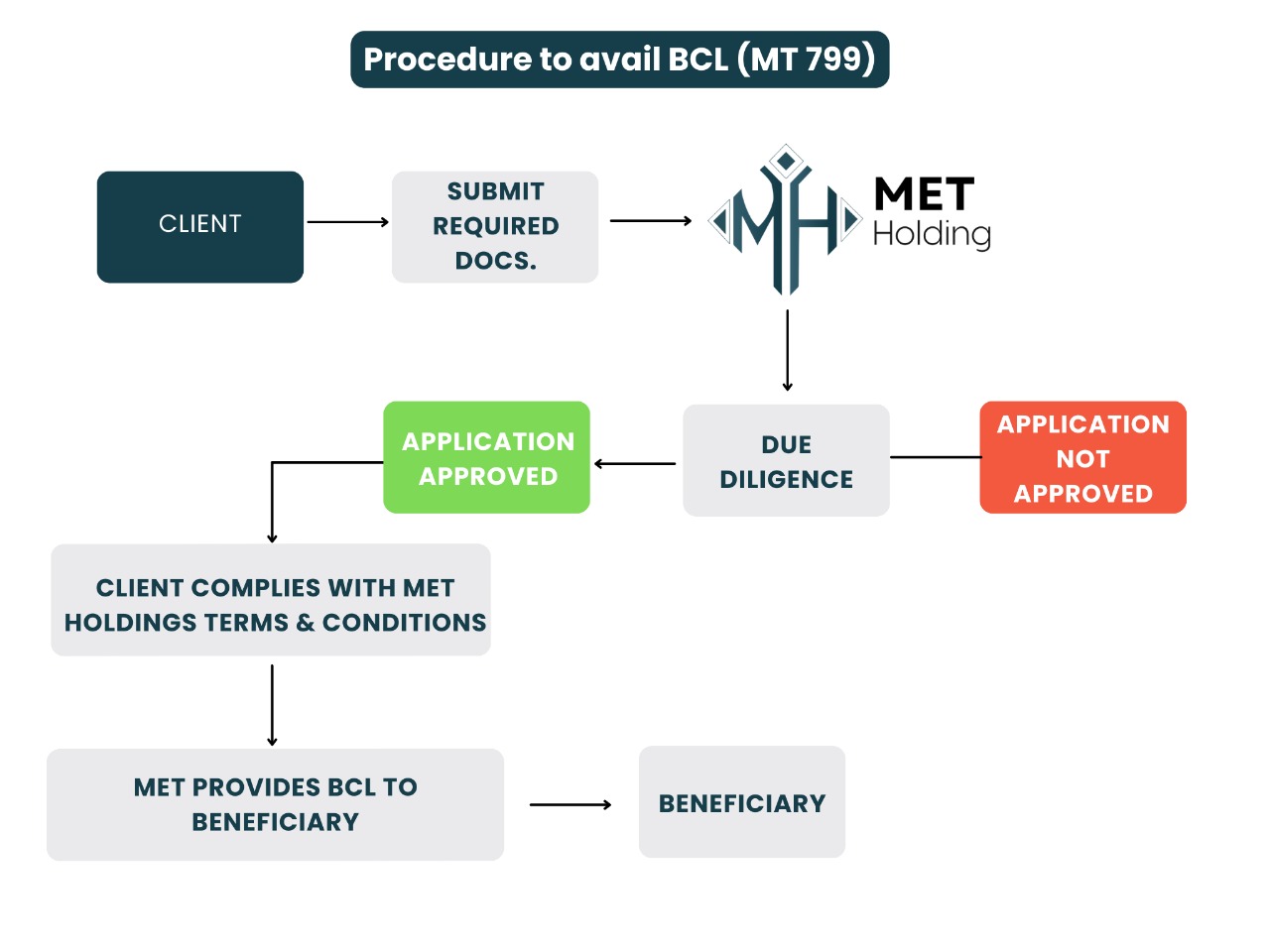

How to Obtain a Credit Line at MET Holding?

At MET Holding, we assist businesses in obtaining a Credit Line from rated financial institutions, providing them with the financial flexibility to manage their operations. Follow the simple process below to apply for and secure a Credit Line:

1. Initial Request Submission

The client submits their Credit Line request to MET Holding, providing relevant documents such as a business plan, financial statements, or trade agreements outlining the credit requirements and terms.

2. Review and Approval

MET Holding will assess the client’s financial standing and the trade or project deal. This includes reviewing the terms, risk factors, and repayment capabilities. After the analysis, we will inform the client of the approval or rejection of their credit line request.

3. Service Agreement and Admin Charges

If the request is approved, the client will be required to sign a service agreement with MET Holding. The client will also be instructed to pay administrative charges to proceed with the credit line process.

4. Structuring and Documentation

After the service agreement is signed and the admin charges are paid, MET Holding will begin structuring the credit line by securing the necessary arrangements with our partner bank. The client will be asked to provide any additional documentation required for the credit line issuance.

5. Issuance of Credit Line

Once all documentation is in order and the client has paid the applicable fees, MET Holding will instruct our partner bank to issue the Credit Line. This will be done through an agreed method, such as a SWIFT MT700 or other banking channels. The credit line will be issued to the client, providing them with the required financial flexibility to proceed with their business operations.

MET Holding ensures a streamlined and efficient process, offering expert guidance and consultancy throughout, to help clients secure the necessary credit line and ensure financial stability for their operations.